Final expense insurance is also referred to as funeral insurance or burial insurance. That pre-empts what it is all about. As the name suggests, its role is to cover funeral expenses and any other medical bill once you die. Since death is often associated with old age, it is common among the elderly. Low-income earners also prefer it due to its affordability. According to experts, it is relatively similar to typical life insurance. However, its premiums and benefits are smaller than regular life insurance policies. That said and done, our discussion today is about covering the costs of funeral expenses with final expense insurance. There are the segments to discuss.

- Funeral expenses that final expense insurance covers

- The average cost of a funeral expenses

- Other Benefits of a final expense insurance

So, if you are considering covering the costs of funeral expenses with final expense insurance, read on!

Funeral Expenses that Final Expense Insurance Covers

When you are gone, you involuntarily leave behind bills that need to be settled so that you can be put to rest. Choosing to have final expense insurance ensures that your family members won’t incur these costs when that day finally comes. Many people often wonder what a dead body would really want as far as finances are concerned. You will be surprised to learn how expensive it is to arrange a funeral. That’s because of the funeral expenses that follow. These expenses depend on whether the funeral is a burial or cremation. Here is a breakdown of the funeral expenses depending on the choice.

Funeral Expenses for a Burial

Its expenses include;

- Basic services fee

- Metal casket

- Embalming

- Vault

- Facilities or staff for the ceremony

- Hearse

- Facilities or staff for viewing

- Removing or transferring the remains fee

- Service vehicles

- Print materials for the memorial

- Other miscellaneous costs

Funeral Expenses for Cremation

The popularity of cremation is also increasing as time goes by. These are the funeral expenses to incur once you choose this path.

- Cremation casket

- Basic service fee

- Embalming

- Fee for third-party cremation

- Facilities or staff for the ceremony

- Urn

- Facilities or staff for viewing

- Removing or transferring the remains fee

- Service vehicles

- Print materials for the memorial

- Other miscellaneous costs

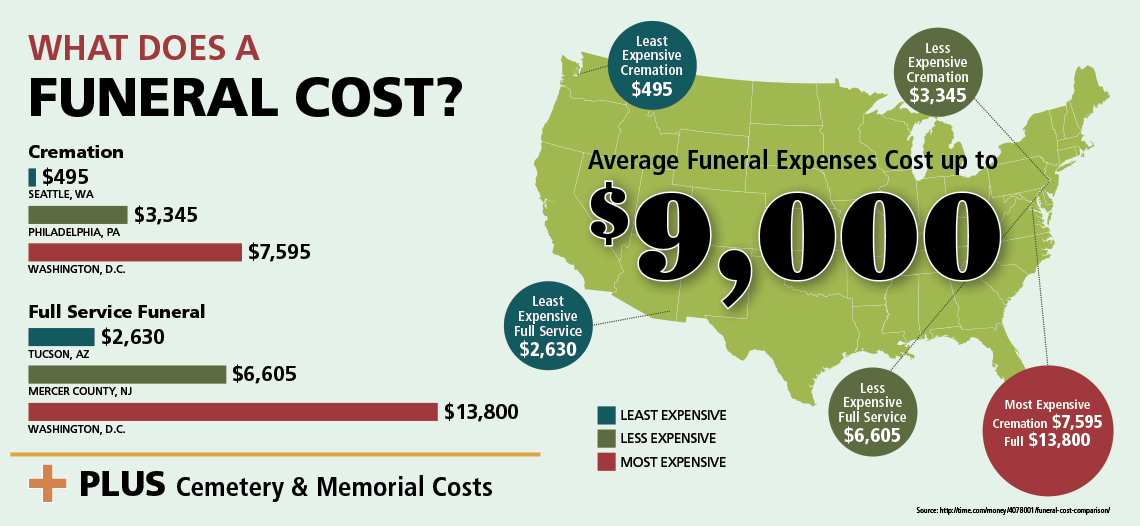

The Average Cost of a Funeral Expenses

Around 2017, it cost a family more than $8000 upon choosing the traditional burial and including the vault. As much as it is less, the difference was not that big regarding cremation funeral expenses. To make matters worse, the cost of funeral expenses keep rising each passing day. Additionally, there are high chances of the figure increasing even further in the future. Why not when the trend clearly shows that.

For instance, funeral expenses were as low as $700 back in 1960. By 1985, the figure had increased to about $2700. As of 2020, the cost stood at around $8000 without a vault and almost $10,000 if the vault was included. Clearly, the figures have been rising over the years. The range of $8000 to $10,000 isn’t to be taken lightly.

So, the money that could cover all the funeral expenses in 1985 can only pay the basic service fee paid at a funeral home or buy a casket. Given the various expenses other than the two, the range unveiled makes a lot of sense, no doubt.

Unlike in the past, when a burial vault wasn’t that much of a big deal, most cemeteries will ask you to avail of it. That’s because the concrete grave box or a burial vault will prevent the ground from buckling over the casket. Its reinforcement preserves the remains from insect infestation and groundwater. So, a grave cost or vault that costs around $1500 has now become part and parcel of funeral expenses.

That’s a huge amount of money, given how sudden death can be at times and the short period available to raise the money. That makes it crystal clear how covering the costs of funeral expenses with final expense insurance policies can be great for your family.

Other Benefits of a Final Expense Insurance

Besides covering the costs of funeral expenses with final expense insurance, there is more than the cover can do for those left behind. Since it isn’t limited to funeral expenses, they can do the following.

-

Pay Medical Bills

It is no secret that medical procedures and prescription costs have become expensive. On the other hand, health insurance policies don’t pay much for medical expenses. Therefore, there are high chances of a person leaving behind medical bills. Under such circumstances, your final expense insurance can also cover the outstanding medical bill. You can rest assured that it will be easy for your loved ones to deal with your send-off if they don’t have to worry about such bills.

-

Debt

One can look at the aspect of debt from two different angles. On one side, your final expense insurance can help your family members pay any outstanding debt. It may not be a lot, but it will surely play a significant role in one way or the other. On the other hand, your loved ones will have money to cover the costs of funeral expenses. Consequently, your send-off won’t leave you struggling with any debts way after the ceremony.

Final Words: Covering the Costs of Funeral Expenses with Final Expense Insurance

It turns out that covering the costs of funeral expenses with final expense insurance is a smart move. After all, funeral expenses are expensive and adding them to grieving only worsens a bad situation. It is one way of ensuring that those left behind gives you a decent send-off without straining financially. The cover can also pay medical bills and any other outstanding debt. While still alive, consider the people you will leave behind. FindMyQuotes can help you make the right choice right away. In your absence, your loved ones will appreciate the fact that you had final expense insurance, no doubt.

Recent Comments