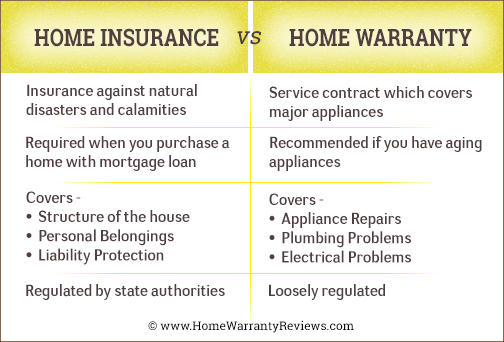

Homeowners often have to deal with this pair of terms, home insurance, and home warranty. A few are lucky enough to know that it is not right to use them interchangeably. Yes, because these are two different things with different meanings and benefits. Therefore, as much as they safeguard your home investment, what they cover is different. Fortunately, by the end of this discussion, you will be in a position to distinguish the two. After all, understanding the difference leaves you in a better position to insure your home and its elements and components. So, what’s the difference between home insurance and a home warranty? Read on to find out.

-

Meaning

What does either of the two terms mean to the homeowner? Here is a highlight.

Home Warranty Meaning

Does your old or new house have home systems and households appliances? If you are nodding, then that’s where the home warranty comes in. The service contract facilitates the repair or replacement of such things. So, if your kitchen appliances, water heater, or electrical system has an issue, a home warranty comes to the rescue if that appliance or system is covered.

It is an ideal option during emergencies, especially if they turn out to be quite expensive. Finding the right person to repair an appliance or home system can be daunting. The same case applies to searching for a suitable manufacturer in case of a replacement. Fortunately, that will no longer be one of your worries once you grab a home warranty.

Home Insurance Meaning

On the other hand, home insurance is more extensive than its counterpart. When a covered peril arises, any damage or loss associated with it is compensated by home insurance. For instance, if it destructs your home structure, the cost of repairing or rebuilding the house comes from the insurance provider. Besides the house, other structures include gazebos, decks, tool sheds, and garages.

In addition to the structure, personal belongings lost or damaged are also not overlooked. That’s why home insurance is recommended for people with expensive items. It covers sports equipment, clothes, and furniture, to mention a few. If the homeowner, family members, or pets cause any property damage or injury, the insurance protects them against lawsuits thanks to the liability protection it offers. Last but not least, any other living expense that may be incurred due to your home being uninhabitable is also sorted by the insurer. The common ones include hotels and meals as long as it is necessary.

-

What is Covered

It is another important piece of information before investing in either or both.

Home Warranty Coverage

What’s covered by your home warranty depends on the purchased plan. If you buy one that covers appliances, it goes without saying that that’s what will be covered. So, your refrigerator, dishwasher, washer, or dryer will be covered. Others go for plans focused on electrical, plumbing, and HVAC systems. You don’t have to get two separate plans to cover the two. Instead, feel free to grab a plan covering the systems and appliances concurrently.

It is also important to note that some items can fall under the home warranty cover, but you will have to pay extra. For example, if you have two air conditioners or dishwashers, the second one will see you pay an extra cost if you want it covered. Other items that need an extra cost include a lawn sprinkler system, well, septic system, spa, and pool.

Home Insurance Coverage

Most home insurance plans cover the home structure, its belongings, and other liabilities when it comes to home insurance. It will compensate you for damages and losses from the following perils and disasters;

- Weight of snow, sleet, or ice

- Volcanic eruption

- Malicious mischief such as vandalism

- Damages by vehicles or aircraft

- Explosion

- Fire

- Lightning

- Windstorm

- Hail

- Civil commotion or riots

- Smoke

- Theft

- Falling object

- Sudden, accidental damages as a result of an artificial generation of an electric current

- Freezing of a household appliance, automatic fire-protective sprinkler, HVAC, or plumbing systems

- Sudden, accidental bulging, burning, cracking, or tearing apart of automatic fire protective, air conditioner, steam, and hot water heating systems

- Accidental overflow or discharge of steam or water from household appliances and HVAC, plumbing, or automatic fire-protective sprinkler systems

Besides that, home insurance also covers personal liabilities for injuries resulting from the following as long as it happens on your home compound;

- Injured domestic support staff

- Intoxicated guests

- Falling trees

- Home accidents

- Dog bites

Don’t expect the following coverings if your home insurance plan is standard;

- Earthquakes

- Floods

Luckily, there are available plans for the same, whether human-made or natural. Additionally, only pay for plans that cover these things if you live in areas prone to these disasters. Otherwise, it might be a waste of money.

-

Cost

Here is a discussion of the cost of each of the two plans.

Home Warranty Cost

There are two costs associated with a home warranty. The first one is a fee that can be annual or monthly, depending on you or the insurer. It allows you to access discounted service calls in case of repair or replacement. The annual price range is between $350 and $1100 but can go beyond that. The cost depends on factors such as the purchased plan and the location of your home.

The other cost is the service fee. Every time you request a system or appliance repair, you get to pay a service fee. Its common range is between $55 and $150 for every request. If the service fee is relatively low, there are high chances that the annual or monthly fee will be high. The vice versa is also true in most cases.

Home Insurance Cost

On average, most homeowners pay around $1200 for a home insurance plan. However, this price differs from one owner since insurers consider several things when determining the premiums. They include the following;

- Credit score

- Marital status

- The chosen coverage and deductible limits

- History of your claims as far as home insurance is concerned

- The rebuilding cost of your house

- Personal belongings’ value

- The condition, size, and features of your home

Conclusion

As similar as the two terms may sound, the difference between home insurance and a home warranty is evident. For instance, the two plans cover different things. Their costs are also different. Therefore, it would be wise to both. Remember to consult a partner who can help you choose the best plan at a reasonable cost. An excellent example is FindMyQuotes, which never disappoints.

Recent Comments