When you buy a house, you might expect to spend a down payment, closing charges, relocation expenses, home inspection fees, and so on. You usually plan and budget for these fees since you know they’re going to happen. But you rapidly learn about all of the unforeseen costs – generally when a big appliance or vital component in your home breaks and you need to spend a huge sum of money in a short period of time to get it fixed.

If you are not prepared, these minor catastrophes can quickly escalate into major financial issues. And if you can’t afford to remedy the problem soon, you risk causing more harm to your home. That is why, whether you are an experienced homeowneror a first-time property purchaser, it is critical to safeguard your assets and funds against unanticipated occurrences. Several strategies can be implemented to do this, the first is to obtain a home warranty.

What is a home warranty ?

For a usual one-year duration, a home warranty covers servicing, or replacement of your home’s key systems and appliances. A home warranty firm issues this sort of warranty contract, which differs from property insurance, which offers financial protection in the case of a catastrophe or accident. Standard homeowners insurance plans cover the structure and contents of a home in the event of a “known risk” mentioned in the agreement, such as weather occurrences, fires, or floods.

Why should you choose a yearly home warranty ?

In most cases, a home warranty is valid for one year. Most home warranty providers, you will find on Find My Quotes, include a yearly service agreement that you can renew each year. It generally covers the key systems and equipment in your home, such as your air conditioning system, heater, and refrigerators. When a major system or equipment fails as a result of normal usage, Find My Quotes covers the expense of repairing it, according to the explicitly specified limits in your agreement. When you deal with Find My Quotes, you can choose from different companies featuring a variety of coverage options.

What are the coverage limits of a Home Warranty ?

- A home warranty only covers ordinary problems, not those caused by accident or abuse. This implies that you must maintain your electronic appliances in order for home warranty to apply. If you fail to maintain an item added to the home warranty and it starts to break down, your home warranty on that specific equipment or appliance may be voided.

- It does not cover pre-existing conditions. For home warranty to apply, make sure your equipment and appliances are in proper functioning condition before you purchase a home warranty.

- Natural calamities such as wildfire or flooding are not covered by a home warranty. That would come under home insurance, which does not cover common malfunctions in the same way that a home warranty does.

Benefits of having a Home Warranty

Buying a home warranty plan offers advantages and disadvantages based on your area, home warranty plan, home and equipment lifespan. Before making any commitments, you should carefully balance these benefits and drawbacks.

Relax while a Home Warranty takes care of your home appliances

Home Warranty benefits two kinds of people especially, first time home buyers and landlords. First time home buyers, if they aren’t used to spending the amount in repairs, home warranty comes in handy and reduces their repair bills. When it comes to landlords, landlords have to take care of appliances in the rented properties. Landlords may charge a rental fee which is under their rental terms and still home warranty allows them to save lots of repair or replacement cost.

Let a home warranty get control over of your bills

It’s common for any home appliances to break down frequently, due to the climatic conditions and water quality. Companies like Find My Quotes will help you find home warranty companies to cover most of your appliances within your home, if they fall under the Home Warranty Terms. A home warranty will also cover the expense will be covered under home warranty, even if it’s a repair or replacement of the specific home appliance. Check our website for more details.

Home warranty Coverage Limit

As we mentioned in the above topic, Home warranty covers only certain categories that fall under home warranty terms. That’s why we always recommend users to buy both Home Warranty and Home Insurance, so you don’t need to worry about a natural calamity or sudden breakdown of your home appliance. Don’t Worry, Check Find My Quotes, we help you find coverage for both based on your requirements.

How Can Find My Quote Help You with Home Warranty?

Find My Quotes strives to help you find most reliable home warranty provider, offering you the greatest home warranty in terms of coverage, service care, and convenience of use. Find My Quotes partners provide more coverage than most other home warranty providers. The claims procedure is simple to follow and may be completed online.

Frequently Asked Questions

-

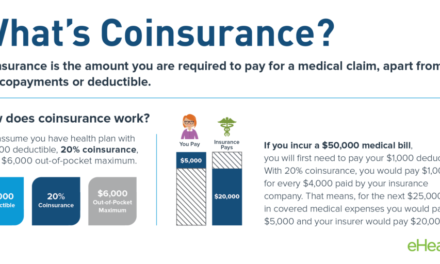

Difference Between a Home Warranty and a Home Insurance Policy?

Home warranty is intended to safeguard your home’s appliances and systems from malfunctions caused by regular wear and tear. Homeowners insurance protects damages and losses caused by unpredictable events such as fire and weather damage, but it does not cover you if your washing machine fails.

-

Should I get a home warranty if I intend to buy a house from previous homeowners ?

When you acquire an older house, you are liable for whatever upkeep that the previous owners did or did not undertake. Get a home inspection done before you buy the house, and make absolutely sure that any severe concerns are fixed before purchasing a Home Warranty.

-

How is the cost of Home Warranty calculated ?

A standard home warranty coverage costs between $350 and $600 per year on average. However, the actual expenditure of a home warranty may vary depending on a number of criteria, including the type of plan you choose and if you select for extra coverage, which can cost several hundred dollars.

Recent Comments