People often confuse coinsurance and deductible, which doesn’t come as a surprise. After all, these two terms have some similarities. That said and done, there are two distinct things as far as insurance is concerned. That’s something most people realize upon finding an insurance plan that demands deductible and coinsurance. A while back, we discussed deductible and its various aspects. Today, our article will focus on coinsurance to help you understand it. By the end of this piece, you should be able to distinguish between the two perfectly. So, without much ado, let’s discuss the important details about coinsurance.

The Meaning of Coinsurance

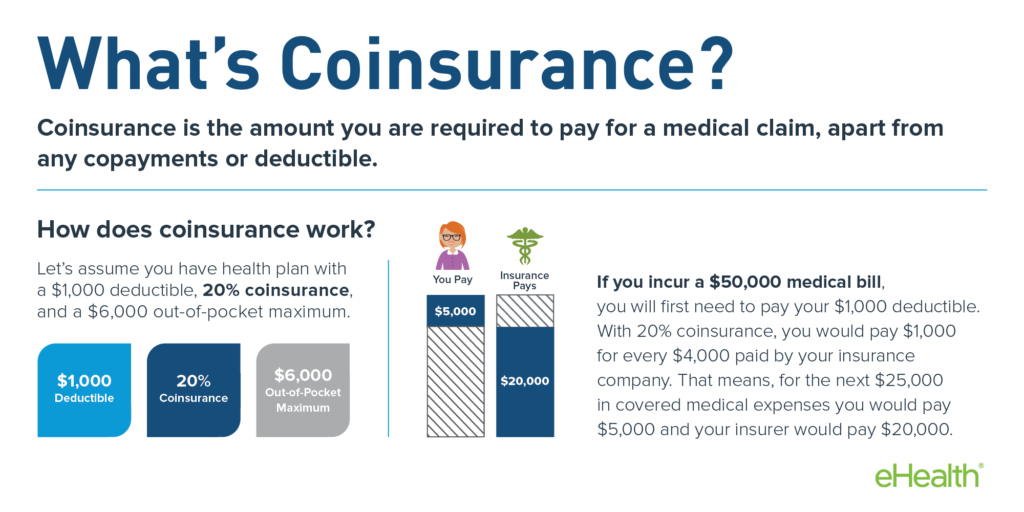

To some extent, coinsurance is similar to a deductible. After all, it is yet another amount of money that you have to pay. However, unlike deductibles, it is not a fixed amount but rather a percentage of the total bill. This percentage differs from one insurance provider to another. So, let’s say that your insurer has agreed on a 10% coinsurance. On one of your hospital visits, you get a bill of $1000. In that case, your health insurance plan pays $900, whereas you pay $100. So, the higher your coinsurance percentage and hospital bills are, the more you will pay.

How Much Can You Pay As Coinsurance

The mere definition of coinsurance makes it quite scary. For instance, can you imagine having a hospital bill worth $400,000 and a coinsurance percentage of 25%? Under such circumstances, that would mean paying up to $100,000 of your hospital bill. Fortunately, that can no longer happen since the insurance system reforms following the Affordable Care Act. It states that there is out-of-pocket money that you can’t exceed as far as ACA-regulated health bills are concerned.

How is Coinsurance Similar to Deductibles?

As earlier mentioned, your coinsurance shares several characteristics. For instance, they are the beneficiaries’ contributions toward their bills. Therefore, their role is to reduce the amount of money your insurance pays after a claim. Insurers include them to ensure that you only seek health care services if necessary. If you know that you will pay a certain portion of your hospital bill, you will avoid incurring them unless it is unavoidable. The two ensure that your health insurer doesn’t pay a lot of money towards your bill.

These two costs are also based on your bill’s discounted rate and not what’s billed right away. So, if your health insurance provider manages to negotiate your hospital bill, it changes what’s expected of you. So, if the bill is $1500 but the insurer bargains and the hospital makes it $1000, that’s the figure to go by. It will be the reference when counting your deductibles and coinsurance.

How is Coinsurance Different from Deductibles?

The main difference is that coinsurance is a variable, whereas deductible is a constant. So, it becomes easy to predict the maximum amount of money you can pay in terms of your deductibles. However, that’s hardly the case when it comes to coinsurance. Once you hit your monthly or annual deductible, you will only pay your deductible once you renew your plan. However, you continue paying your coinsurance every time there is a bill. That said and done, you can stop paying coinsurance upon reaching the agreed out-of-pocket maximum. Given how high that limit can be most of the time, it hardly happens unless you deal with big hospital bills. Under such circumstances, it becomes easier to budget for deductibles than coinsurance. You don’t know the next amount to pay until you see the bill.

How Does Coinsurance Work?

Here is a possible scenario to help you understand the concept better. In this case, we have someone with a hospital bill of $15,000. After the insurance provider negotiates, the amount goes down to $12,000. What’s expected of the beneficiary if the deductible is $3000, coinsurance is 20%, and the out-of-pocket maximum stands at $6,850? It is the amount to pay as far as this case is concerned. The first payment by the patient will be $3000 as the deductible. What’s left after that is $9000 from the total of $12000. So, coinsurance will be 20% of that remainder, making it $1800. The patient will pay $4800, whereas the insurance company pays the rest.

We had mentioned the put-of-pocket maximum earlier. It was $6,850, whereas the beneficiary had to pay is $4,800. Therefore, the patient shouldn’t expect any consideration in such a case. However, if the figure exceeded that, the patient wouldn’t pay any other penny out of pocket until the plan’s period lapsed.

Does Coinsurance Affect Insurance Premiums?

In most cases, the answer to that question is a resounding yes. So, if you are paying a relatively high coinsurance, expect your premiums to be pretty low. The vice versa is also true most, if not all, the time.

Various Categories of Coinsurance

Most health insurance plans put at your disposal four main categories. They have one thing in common, and that’s the fact that they only apply once the beneficiaries exceed their deductible. However, they are different as far as the coinsurance percentage is concerned. So, let’s take a look at the four different categories.

-

Platinum

In this category is as low as 10%. So, if the remaining bill after the deductible is $1000, you only pay %100, whereas the insurance provider pays $900, which is 90%.

-

Gold

In this category is as low as 20%. So, if the remaining bill after the deductible is $1000, you only pay $200, whereas the insurance provider pays $800, which is 80%.

-

Silver

In this category is as low as 30%. So, if the remaining bill after the deductible is $1000, you only pay $300, whereas the insurance provider pays $700, which is 70%.

-

Bronze

In this category is as low as 40%. So, if the remaining bill after the deductible is $1000, you only pay $400, whereas the insurance provider pays $600, which is 60%.

Keep in mind that the higher the percentage, the lower the premium rates and vice versa.

Final Words

Coinsurance means having to contribute towards your bill whenever a need arises. That’s something the fee has in common with the deductible. However, unlike its counterpart, it is a variable. Its figure depends on the bill unless the out-of-pocket minimum is reached. Besides the bill amount, coinsurance is also determined by the set percentage. There are various categories of coinsurance to choose from as well. Keep in mind that FindMyQuotes can always help you choose the best insurance plan. It considers all the important aspects, and coinsurance is no exception.

Recent Comments