When it comes to most health insurance plans, beneficiaries pay out-of-pocket charges. We have already discussed some of them, including coinsurance and deductible. They are not the only charges, and that’s why our article focuses on yet another charge. It is none other than the copayment, often referred to as copay. What is it, and what does it mean to the insurance provider and the beneficiary? How much do you have to pay if it is part of your health insurance policy? You will have the answers to these questions by the end of this discussion. So, let’s dive into this interesting topic to learn as much as possible about health insurance copayment.

What is an Insurance Copayment?

A copayment or copay is a set amount of money you pay as part of your contribution to the hospital bill every time you visit the hospital. It usually applies to drug prescriptions and doctors’ visits. Your health insurance provider determines the amount of money you pay for every bill. It is also a predetermined figure hence predictable. Therefore, always ensure that you take note of the expected copay every time you purchase a health insurance cover.

How is Copayment Similar to Coinsurance?

The mere definition of copayment can make you think it is the same as coinsurance. After all, they are both part of the beneficiaries’ contributions toward their health bills. Once the hospital declares the amount of bill required, the insurance provider pays its part, whereas the patient does the same. The contribution can be in the form of a copayment, coinsurance, or both.

Besides that, copayment and coinsurance have yet another similarity. The two are paid every time you visit your doctor. So, the more you visit the bill, the more you will pay in terms of copayment and coinsurance.

You pay your coinsurance and copay once you have reached your deductible. If the bill is smaller than your deductible, you will not pay the either cost. On the contrary, you will cater to the entire cost by paying the expected deductible. On the other hand, once you exceed the deductible, you can pay your copay, no doubt. If your health insurance plan also demands you to pay coinsurance, that’s when you also make that charge.

How is Copayment Different from Coinsurance?

Whereas the pair is similar in several ways, it also has its differences.

-

Nature of Contribution

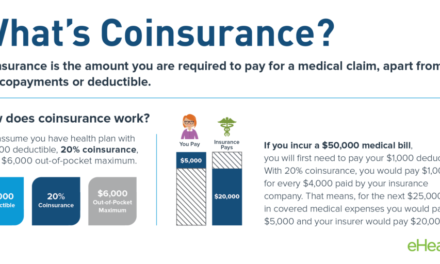

The major one is the nature of these contributions. We have the coinsurance, a percentage of the total hospital bill, on one side. On the other hand, there is copayment which is a constant. Therefore, the amount of payment you pay as a copayment doesn’t change regardless of how small or huge the hospital gets. If your copayment is $25, you get to pay the same even if the bill is $1000 or $2000.

Nevertheless, that’s quite different when it comes to coinsurance. The amount you pay depends on the bill that needs to be settled since the figure is a percentage of the payment. So, if your coinsurance is 10%, you will pay $100 if the bill is $1000 and $200 in case the bill is $2000.

2. Contribution Towards Maximum Out-of-Pocket Limit

Another difference is their contribution towards the maximum out-of-pocket limit of your insurance. Every coinsurance that you pay puts you a step closer to reaching the maximum out-of-pocket amount of your policy. Therefore, there are high chances of reaching that limit hence eventually not paying anything for the hospital bills that come after that. That’s a different case when dealing with a copayment. No matter how much you pay as copay, they will not be counted as part of what you have paid towards your health bills. So, it won’t be considered when calculating your out-of-pocket amount. However, you won’t pay copay or coinsurance upon reaching your maximum out-of-pocket limit.

Other Interesting facts about Copayment

Besides how similar and different copayment is from coinsurance, there are other things about it worth highlighting. They include;

-

The Maximum Rate of a Copayment

It is important to acknowledge that the copay set by health insurance isn’t quite a huge amount. As a matter of fact, it hardly exceeds $25. It is always less than that and up to $30 on rare occasions. However, it is important to note that the copay to pay for one service may differ from what you pay for when seeking another service. For instance, you may pay $10 only for a drug prescription but $25 for a doctor’s visit under the same insurance coverage.

Besides that, your copay may be different for various prescription drugs. Whereas a drug from a preferred brand may demand a copayment of $25, that could change to $10 for a generic drug. It can rise to $50 if the drug is from a non-preferred brand name or stand at even $100 if it is a specialty drug.

So, one can say that copay isn’t a constant per se. It only remains a fixed amount when paying for the same medical services. Otherwise, you might notice some inconsistencies.

-

The Effect of Copay on your Health

It is no secret that health insurance plans also require their beneficiaries to pay premiums. That said and done, the amount of copayment you pay may affect your premium rates. On many occasions, the higher the copay, the lower the monthly or annual premiums and vice versa.

-

When Does Health Insurance Copayment Apply?

If your health insurance plan doesn’t include a copayment fee, you won’t be expected to pay a penny regarding that. The same case applies when seeking preventive care services and some annual checkups. So, don’t expect to pay a copay under these circumstances;

- Childhood immunizations

- Checkups

- Well-woman visits

- Annual preventative care

After all, there are medical services that your insurance provider can only cover. That’s because they prohibit any payment paid out of your pocket.

On the other hand, you don’t need to pay a copay for all the medical services offered. It all narrows down to what your policy says. Nevertheless, some services commonly need you to pay this fee. They include;

- Specialists’ visit

- Emergency room visit

- Physician visits

- Drug prescription

Conclusion: Health Insurance Copayment

It is a common out-of-pocket cost that your health insurance provider expects you to contribute every time you access certain medical services. It differs from one insurer to the other. Additionally, it affects what to pay out of your pocket and your premium rates. Therefore, always be keen when choosing a health insurance plan. Never underestimate the copay aspect either. FindMyQuotes can help you get a perfect plan without overlooking such important aspects.

Recent Comments